Canopy Asset Classes

Introduction

Canopy allows individual users to classify assets as per their own definition (e.g. some users like to classify Bank Deposits under Cash, but others would prefer to keep Deposits as a separate asset class). However there is also a requirement for a standardized Canopy Asset Class for each asset. This is to facilitate use cases where portfolios of different users need to be compared. For example

- Comparing your asset allocation to the model portfolio from a bank

- Comparing Asset Allocation or Performance with your peer group

What are the Canopy Asset Classes

There is no 'one correct way' of classifying assets into asset classes and this topic can be somewhat contentious. This document shows our current methodology of classification but we fully expect it to evolve over time. Please contact us in case you have feedback or would like to contribute.

Classification Levels

Currently the proposal is to have upto 5 levels of classifications for each asset. The 'levels' will depend on factors like

- Size of the Universe e.g. US equities (maybe with Canada blended in) deserve to be treated as a separate level, but most other countries can be grouped into regional classifications.

- Price movement of that particular asset i.e. how it behaves in terms of price movements compared to other asset classes.

Practical Considerations

While it makes sense to have US / China / Japan as separate Geographies on their own (because of the size of the market as well as their popularity with Canopy customers), it does not make sense to do so for every country. So we will 'group' certain countries into buckets. These grouping may change as we get more and more customers on a particular geography (e.g. currently India does not have a separate bucket, but that might change as we get more customers who focus on Indian assets)

| Level 1 | Level 2 | Level 3 | Level 4 | Level 5 | Complete name of Canopy Asset Class | Example |

|---|---|---|---|---|---|---|

| Equity | DM | Listed | Americas | US | Equity_DM_Listed_US | IBM Shares IBM_US |

| DM | Listed | Europe and ME | Germany | Equity_DM_Listed_Europe | Deutsche Bank DBK_GR | |

| DM | Listed | Pacific | Japan | Equity_DM_Listed_Japan | iShares MSCI Japan ETF EWJ_US | |

| DM | Listed | Pacific | Singapore | Equity_DM_Listed_Other | Singtel | |

| EM | Listed | Asia | China | Equity_EM_Listed_China | Tencent 700_HK | |

| EM | Listed | Asia | India | Equity_EM_Listed_Asia_ex_China | Larsen and Toubro LT.NS | |

| EM | Listed | Americas | Brazil | Equity_EM_Listed_Americas | PetroBras PBR_US | |

| EM | Listed | EMEA | Egypt | Equity_EM_Listed_EMEA | Telecom Egypt TEEG | |

| DM | Unlisted | Americas | US | Equity_DM_Unlisted | Uber | |

| EM | Unlisted | Asia | India | Equity_EM_Unlisted | Bharat Sanchar Nigam | |

| Fixed Income | DM | IG | Fixed Income_DM_IG | Temesek Financial Bonds | ||

| DM | HY | Fixed Income_DM_HY | Sprint Corp Bonds | |||

| EM | IG | Fixed Income_EM_IG | Russian Federation Bonds | |||

| EM | HY | Fixed Income_EM_HY | iShares Emerging Market HY Bond ETF EMHY | |||

| Unrated | Fixed Income_Unrated | |||||

| Others | Fixed Income_Others | |||||

| Alternatives | Hedge Funds | Alternatives_Hedge Funds | Renaissance Technologies | |||

| Private Equity | Alternatives_Private Equity | Carlyle | ||||

| Commodity | Alternatives_Commodity | SPDR Gold Trust GLD_US | ||||

| REIT | Alternatives_REIT | Ascendas REIT | ||||

| Insurance | Alternatives_Insurance | |||||

| Others | Alternatives_Others | |||||

| Derivatives | Derivatives | Accumulators | ||||

| Real Estate | Real Estate | Apartment in Singapore | ||||

| Others | Others | Art |

Guidelines for Classifications

Where do ETF/Mutual Funds go?

We are proposing the following logic

- In cases where all the assets of a particular ETF / Mutual Fund fit inside a particular Canopy Asset class, that ETF/Mutual Fund should be classified under that Canopy Asset class. For example SPY US <Equity> should be classified under Listed Equity (US).

- For cases where the assets of a particular ETF / Mutual Fund do not fit inside a single Canopy Asset class, but do fit inside 3 or 4 (e.g VT US <Equity> or Vanguard World Equity) the ideal solution would be to do a look through and allocate proportionally to all asset classes. However this feature is still being built.

- If enough information is not available then someone in Canopy will use their best discretion to classify

Does the Country of Listing matter?

No. We go with the underlying country. e.g. Baidu is listed in NY but will be classified as Chinese

Does Currency of Listing matter?

No. EWJ is Nikkei 225 in USD. It should be classified as Japanese equity

How to classify countries / regions into EM/DM/FM

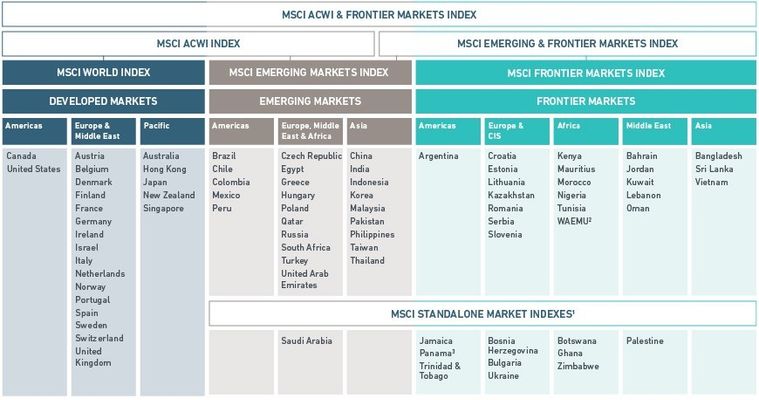

We propose to broadly (but not exactly because of practical considerations) follow MSCI's classification attached below

Detailed Country Classification

Each country is classified into Developed Market, Emerging Market or Frontier Market. Within these categories all countries except US, Japan and China are clubbed into a single category called Others. Details are in the page linked below

List of Geographical Classifications

Chinese Stocks Incorporated In Cayman Islands

There is a 'manual override' for Cayman listed stocks and they are classified on a best effort basis according to countries where their main business is. A list of overrides is below

Products

A user could be getting exposure to a particular asset class using any kind of product. e.g. exposure to US equities can be had through vanilla equity, ETFs, Mutual Funds or Structured Notes. Therefore our proposal is to tag each security with a Product classification as well. This will help to get granular information from a different dimension if required.

Some Examples

| Security | Canopy Asset Classification | Product |

|---|---|---|

| SPY US <Equity> | Equity_DM_Listed_US | ETF |

| OTC option on Tesla shares | Equity_DM_Listed_US | Option |

| Japanese Equity Mutual Fund | Equity_DM_Listed_Japan | Mutual Fund |

| IBM Shares | Equity_DM_Listed_US | Vanilla Equity |

| Toyota Shares | Equity_DM_Listed_Japan | Vanilla Equity |

| Ten Cent Shares | Equity_EM_Listed_China | Vanilla Equity |